Fix Your Clark County, NV Tax Cap For Your Residential Home

As your real estate professional I wanted to inform you (in case you haven’t heard already!) the Clark County Assessor has been incorrectly taxing owner-occupied (primary residence) properties at the investor rate of 8%.

In 2005, the Nevada State Legislature passed a law to provide property tax relief. Assembly Bill 489 provides for a partial abatement which limits annual tax increases on an owner’s primary residence to no more than 3%, and for all other properties, no more than 8%. This is referred to as the “tax cap”.

The Assessor’s Office recently mailed out Tax Cap Abatement Notices to residential property owners who purchased property or had a change in ownership after July 1, 2021 in Clark County. These property owners may be eligible for the primary tax cap rate for the 2022-2023 fiscal year. Property owners may submit a claim by signing the bottom portion of the postcard and returning it to the Assessor’s Office by mail or in person.

How To Find Your Property Tax Rate

1) Visit the Property Records Section of the Clark County Assessor

2) Search by Your Name, Address or Parcel Number

3) On your address row, click the blue Assessor’s parcel Number (APN)

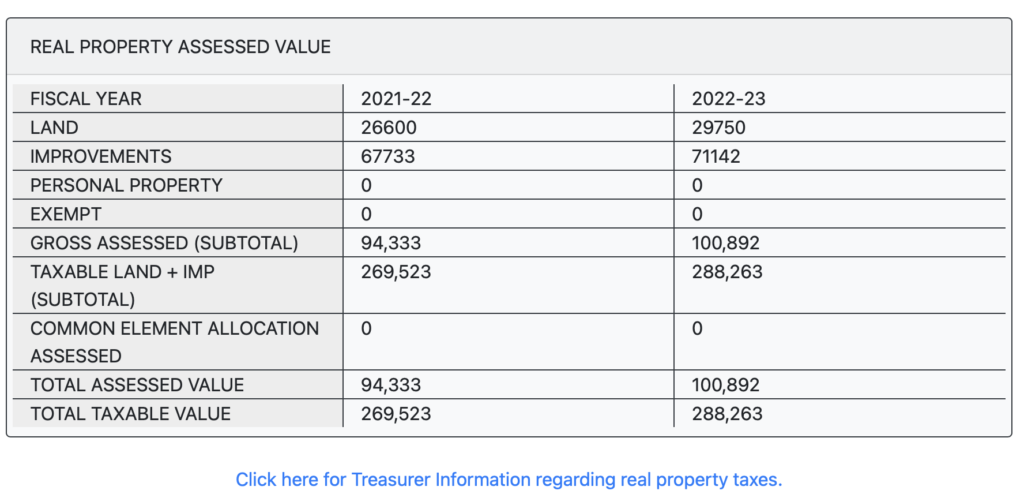

4) Scroll down and click for Treasurer Information regarding real property taxes.

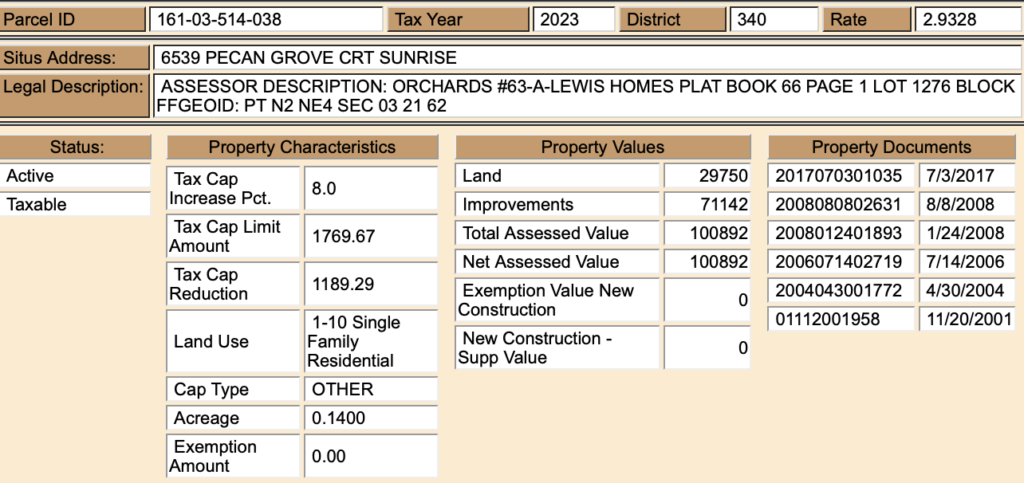

5) Under property characteristics, there will be a Tax Cap Increase Percentage. Yours will probably say 8.0, but don’t worry!

6) Look at the NET ASSESSED VALUE – In this case $100,892 (This is not the market value of your home, but the algorithm in which the county assesses the value of your home for tax purposes. If you would like a complimentary professional Broker’s Price Opinion of your home, send me an e-mail, call or text and we will prepare one for you)

7) Divide the Property Tax Principal by the Total Assessed Value and Multiply by 100 to determine your tax percentage.

Example: $1,796.67 / $100,982 = 0.01752461 x 100 = 1.75246083— This is your current property tax rate.

8) However, the County may begin taxing you at the investor (non-owner occupied) rate if you do not notify them. To do this, you can mail or e-mail this form to save you a trip to the hectic Clark County Assessor’s Office)

9) Enter your Parcel Number on this form (found on the Assessor’s search above) and fill out the rest of your information. Sign & Date, and mail to:

BRIANA JOHNSON

CLARK COUNTY ASSESSOR

500 S GRAND CENTRAL PKWY

PO BOX 551401

LAS VEGAS NV 89155-1401

OR E-MAIL TO:

AOCustomerServiceRequests@ClarkCountyNV.gov

If you have any questions or need help, respond to this e-mail, shoot me a text or give me a call. I’d be happy to help.

Have a safe Holiday weekend!

With gratitude,

Jordan C. Dove, ABR® SFR®

MANAGING PRINCIPAL | REALTOR®

Dove & Associates Powered by Nationwide Realty

702.767.5557 | Jordan@DoveandAssociates.com

JordanDove.com | DoveandAssociates.com

Subscribe to my YouTube Channel

3960 E. Patrick Ln. Ste. 204

Las Vegas, NV 89120

NV Lic. # S.0180594